Bitcoin has always been championed by the crypto community as an example of the spirit of decentralization. While the decentralized nature of Bitcoin’s Proof-of-Work consensus algorithm has often been discussed in great detail, no systematic study has so far been conducted to quantitatively measure the degree of decentralization of Bitcoin from an asset perspective – How decentralized is Bitcoin as a financial asset? We present in this paper the first systematic investigation of the degree of decentralization for Bitcoin based on its entire transaction history. We proposed both static and dynamic analysis of Bitcoin transaction network with quantifiable decentralization measures developed based on network analysis and market efficiency study. Case studies are also conducted to demonstrate the effectiveness of our proposed metrics.

Evolve Path Tracer: Early Detection of Malicious Addresses in Bitcoin with Evolve Path Graph

With the ever-increasing boom of Bitcoin, detecting fraudulent behaviors and associated malicious addresses draws significant research effort. However, most existing studies focus on designing address-level features for a specific kind of malicious activity. Although there are few studies can detect categories of malicious activities, they still rely on the full history features or full-fledged address transaction networks,

thus cannot meet the requirements of early malicious address detection which is urgent but seldom discussed by existing studies.

In this work, we present Evolve Path Tracer, a novel approach for the early detection of fraud behaviors of malicious addresses. Specifically, in addition to the address features, we propose the concept of backward and forward asset transfer paths to characterize early transaction patterns. To fully utilize the critical information among these asset transfer paths, rather than building an address graph, a path graph is proposed to capture the critical information among related transactions and addresses. Further, since the transaction pattern are changing rapidly during the early stage, we adapts the path encoder and path graph module along the temporal dimension under an evolving structure setting. We investigate the effectiveness and versatility of Evolve Path Tracer on three real-world illicit bitcoin datasets. Our experimental results demonstrate that Evolve Path Tracer outperforms the state-of-the-art methods.

Toward Intention Discovery for Early Malice Detection in Bitcoin

An ideal detection model is expected to achieve all the three properties of (I) early detection, (II) good interpretability, and (III) versatility for various illicit activities. However, existing solutions cannot meet all these requirements, as most of them heavily rely on deep learning without satisfying interpretability and are only available for retrospective analysis of a specific illicit type.

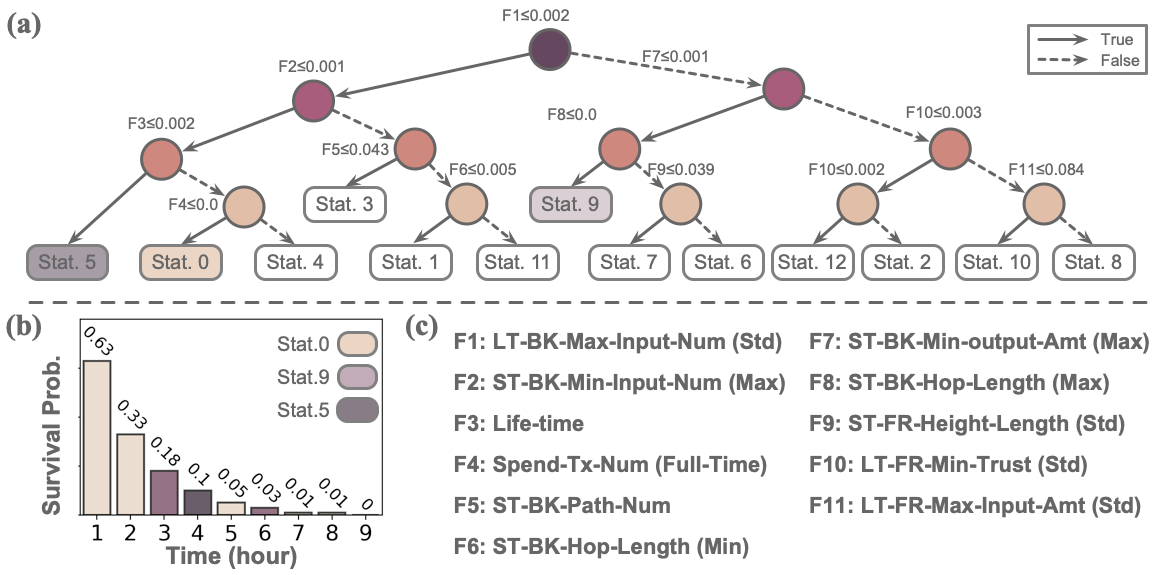

With a decision tree based strategy for feature selection and segmentation, we split the entire observation period into different segments and encode each as a segment vector. After clustering all these segment vectors, we get the global status vectors, essentially the basic unit to describe the whole intention. Finally, a hierarchical self-attention predictor predicts the label for the given address in real-time. A survival module tells the predictor when to stop and proposes the status sequence, namely intention.

With the type-dependent selection strategy and global status vectors, our model can be applied to detect various illicit activities with strong interpretability. The well-designed predictor and particular loss functions strengthen model’s prediction speed and interpretability one step further. Extensive experiments on three real-world datasets show that our proposed algorithm outperforms state-of-the-art methods. Besides, additional case studies justify our model can not only explain existing illicit patterns but can also find new suspicious characters.